Is it Bubble Time again?

Few would dispute the investment wisdom of Warren Buffett, the “Oracle of Omaha”.

From Kiplingers:

“The bottom line is that over the past six decades, Buffett – through acquisitions, investments and opportunistic ventures – did something that’s unlikely to ever be repeated. He essentially doubled the performance of the broader market.

What that meant for anyone lucky enough to get in on the ground floor with Buffett has been nothing less than astonishing. If you invested $1,000 in Berkshire stock in 1965, it would today be worth about $33 million.

The same sum invested in the S&P 500 would be worth about $336,000 today.”

From a July article in MSN:

”The stock market just blew through Warren Buffett’s favorite danger signal”

”U.S. stocks have soared, with the Wilshire 5000 market cap hitting a new all-time high of 212% of GDP, one of Warren Buffett’s key warning levels. Despite global indexes near record highs, we’re seeing mild selloffs this morning. In addition, Goldman Sachs reported a high level of speculative trading activity.”

From GuruFocus on September 4:

”The Ratio of Wilshire 5000 over GNP compares the total market value of all publicly traded stocks in the Wilshire 5000 index to the Gross National Product of the United States. This ratio, essentially the Buffett Indicator provides an assessment of the stock market’s valuation relative to the nation’s economic output.

Buffett Indicator was 2.143 as of 2025-09-04, according to GuruFocus. Historically, Buffett Indicator reached a record high of 2.143 and a record low of 0.312, the median value is 0.89. Typical value range is from 1.26 to 1.84.”

To recap. Warren Buffett, our most respected investor, based on performance over decades, that guy is telling us something.

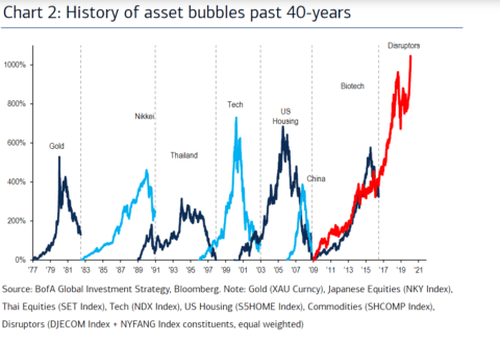

So what could go wrong now? We are obviously in bubble territory. Everything feels fragile. Will it be a “crypto crash”? Probably sooner or later. After all, crypto is only as valuable as it is popular. Someday, someone will start to sell quickly after having made a quick buck. The panic will be contagious. All Ponzi schemes end that way.

However, there is another “speculation” that is attracting hundreds of billions of “investment” dollars. Real dollars. On the way to trillions. That investment has shown very little ROI (return on investment). And promises to blow through billions more before providing a profit.

Welcome to the world of Artificial Intelligence. Arguably the most overbought, over promised tech development – ever. Some of us of a certain age remember that the “Internet” was going to make everyone rich. Look up the “dotcom” crash of 2000.

AI or artificial intelligence has become a “given”. The ARE ways that it will help us. And we float along trusting that computer science will deliver to us another “printing press” or another “automobile” or another “internet” – another wonder of human ingenuity that will transform our lives and make us all wealthier.

But the industry has become over invested based on a simple idea – a promise of something greater. The “bet” is that AI can become AGI – “Artificial General Intelligence”. A system that is so smart it can teach itself, correct it’s own errors and grow organically into something that will provide enormous return on investment (ROI).

While AI is a natural outgrowth of the computer age, it also has become the greatest financial bet in human history. And it doesn’t expect to make any money for several years. What could go wrong?

The recent release of ChatGPT-5 has been a flop.

Here are some clips from a revealing article in The American Prospect.

”If the AGI dream is over or even delayed, the investor nightmare is just beginning. The fallout from AGI hucksters like Altman won’t just devastate Silicon Valley and the tech sector. The U.S. economy is dangerously dependent on Big Tech and has priced its investments on the promise of AGI. What happens, not just to the Valley but to the global economy, if there is no AGI coming?”

“Unlike most software we’re familiar with, LLMs are probabilistic in nature. This means the link between the dataset and the model is broken and unstable. This instability is the source of generative AI’s power, but it also consigns AI to never quite knowing the 100 percent truth of its thinking. This explains the chasm in model performance by ChatGPT. One day, it is helping conduct Ph.D.-level research, and the next it is miscounting the number of R’s in strawberry, or struggling to answer whether 9.11 or 9.9 is a bigger number. (Note: 9.9 is bigger, a fact I determined without the use of AI.)

“Hallucinations are a by-product of this structural flaw in the way LLMs operate. Because pre-training scaling makes the models bigger but does not constrain or shape their behavior, it cannot solve the hallucination issue. We saw this when GPT-4o was released last year, and its hallucination rate increased compared to earlier models.”

”The technological struggles are in some ways beside the point. The financial bet on artificial general intelligence is so big that failure could cause a depression.”

”….if AGI is still a faraway dream and the industry’s technical leader (OpenAI) has no clear pathway to it, then the Valley has made a terrible bet. According to CB Insights, there are 498 AI unicorns, or startups worth at least $1 billion, turning the $350 billion in VC investments since 2021 into a total valuation of $2.7 trillion. Those valuations will be hard to justify if no one has a ready solution to keep the current pace of progress going.”

”By 2026, OpenAI projects its losses to grow to $14 billion a year, despite seeing another jump in ARR to around $30 billion. The startup doesn’t expect to break even until it can clear $100 billion a year in revenue, the number targeted for 2029. Zitron considers OpenAI the paradigmatic example of what he calls “the rot economy,” a company that “burns billions to lose billions.”

”On the one hand, this is a testament to the sheer scale of the AGI buildout; on the other, it is a flashing red light for an economy with frightened consumers, a softening labor market, a frozen housing market, and roiling uncertainty from Trump’s tariffs. The economic tide seems to be rushing out everywhere except the tech economy, but that may have already gone bust.”

Warren Buffett’s Berkshire Hathaway has recently been a net seller of equities. They are holding over $350 billion in cash equivalents.

https://www.kiplinger.com/investing/warren-buffett-quotes-for-investors-to-live-by

https://prospect.org/economy/2025-09-04-what-if-theres-no-agi/?utm_source=ActiveCampaign&utm_medium=email&utm_content=When%20the%20AI%20bubble%20pops&utm_campaign=Daily%20Prospect%2009-05-2025

Leave a comment