The view from Space

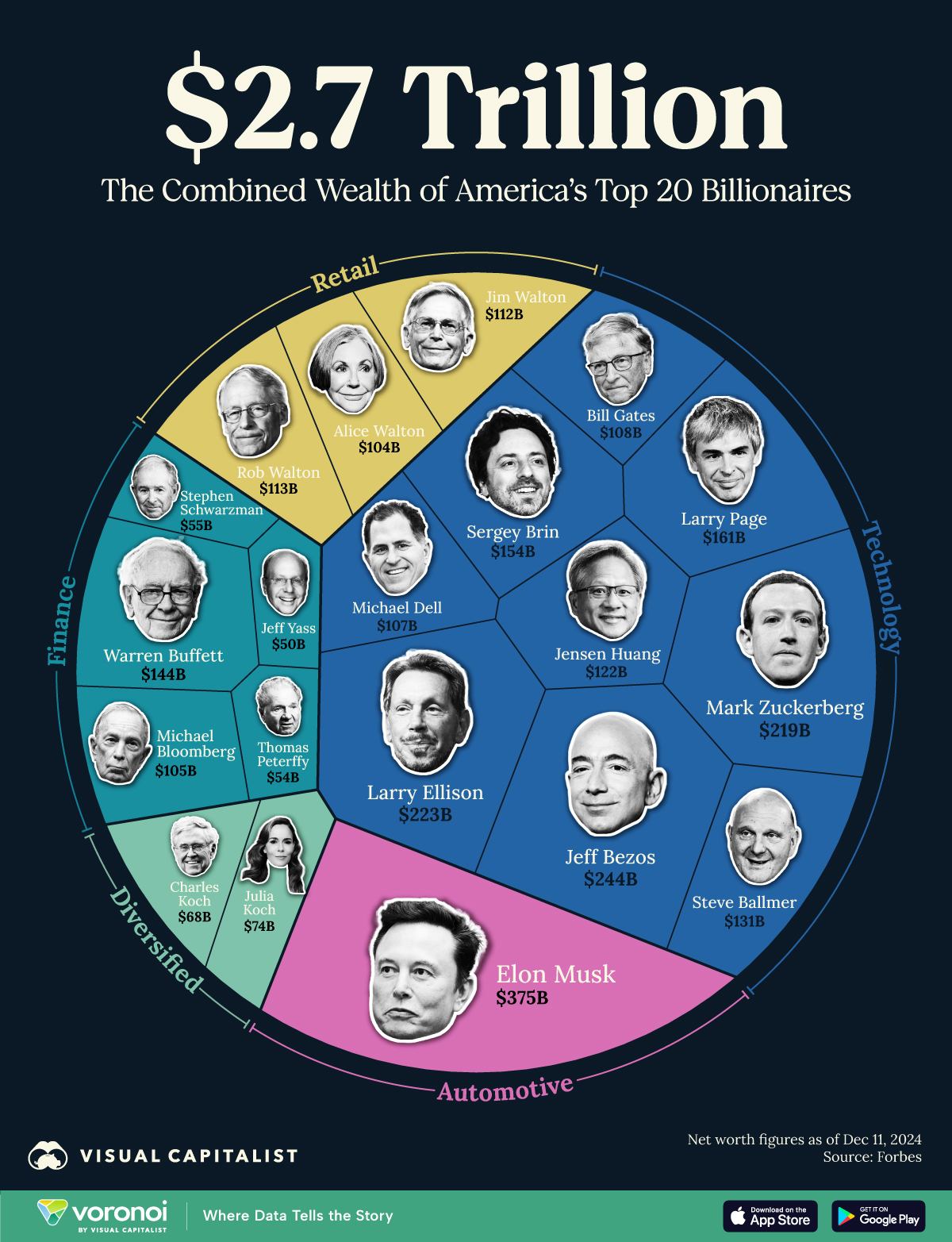

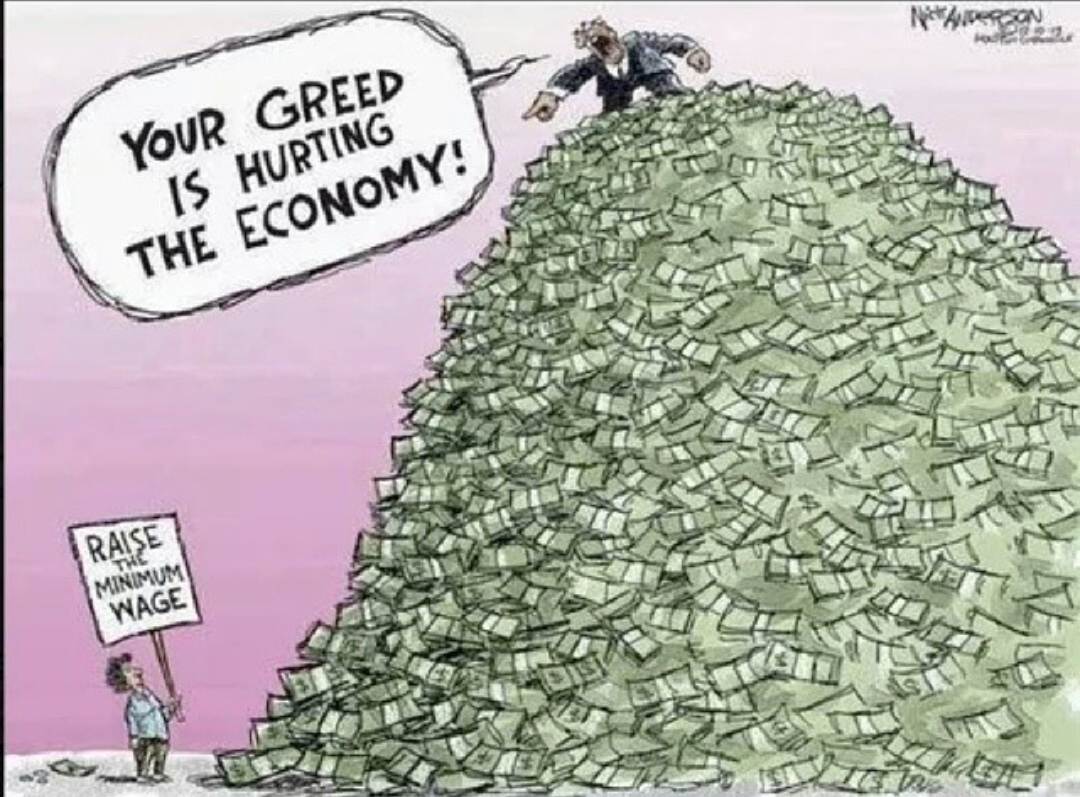

I believe that what has fueled the current state of anger in America is that too many people are suffering from economic insecurity. The “culture wars” are encouraged by the ultra rich to hide their hoarding of the national wealth. It is a clever diversion from the fact that a few people own more than all the rest of us.

Ask this question of Google: “What percentage of wealth do the top 10% have?”

Answer: “In the United States, the top 10% of households hold approximately 67-71% of total household wealth, according to recent data from the Federal Reserve and the Congressional Budget Office.”

What follows is long. Part 1 discusses the US tax system when compared to other developed nations. Part 2 is shorter. It talks about the insidiousness of recent legislation.

But if you are short of time, skim 1 and 2 – scroll right to Part 3 and explore a solution to the EXTREME unfairness of our kleptocratic system.

Part 1 – Taxes as viewed from space

Much of what you read next is taken from The Tax Policy Center. I have bolded some statements for emphasis.

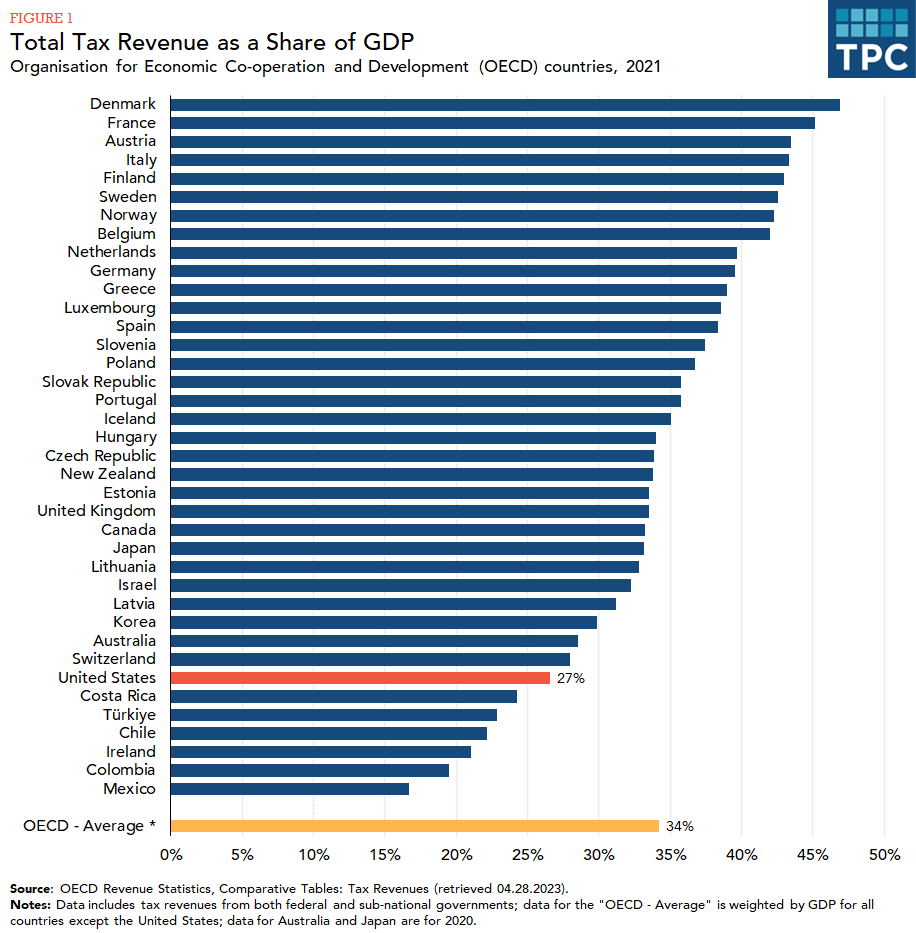

TOTAL TAX REVENUE

US taxes are low relative to those in other high-income countries (figure 1). In 2021, taxes at all levels of US government represented 27 percent of gross domestic product (GDP), compared with a weighted average of 34 percent for the other 37 member countries of the Organisation for Economic Co-operation and Development (OECD).

Six OECD countries (Chile, Colombia, Costa Rica, Ireland, Mexico, and Türkiye) collected less tax revenue than the United States as a percentage of GDP. Taxes exceeded 40 percent of GDP in eight European countries, including Denmark, where taxes were 47 percent of GDP. Those countries generally provide more extensive government services than the United States does.

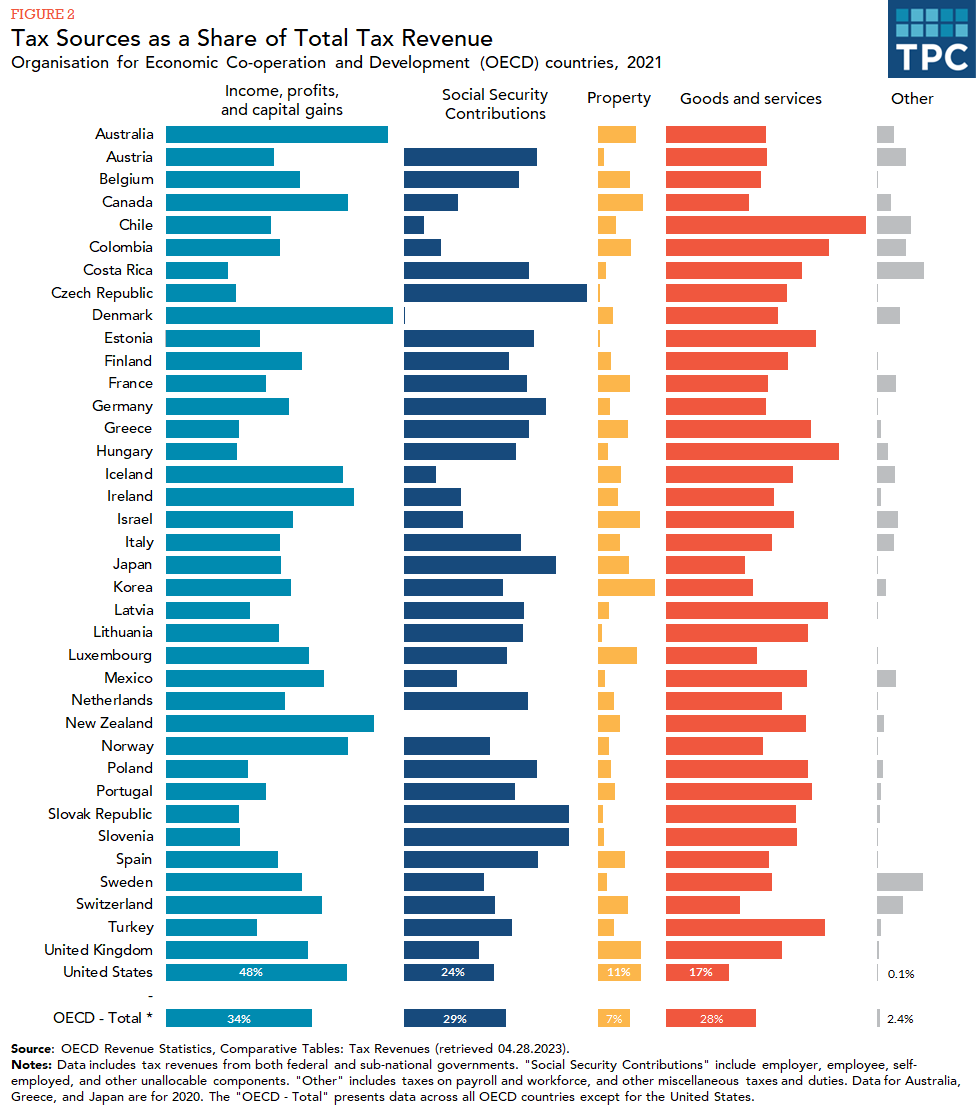

COMPOSITION OF TAX REVENUE

Income and Profits Taxes: Taxes on personal income and business profits made up 48 percent of total US tax revenue in 2021, a higher share than in most other OECD countries, where such taxes averaged 34 percent of the total (figure 2). Australia, Denmark, and New Zealand were the only OECD countries where over half of total revenue was generated from such taxes.

In the United States, taxes on just the income and profits of individuals (not businesses) generated 42 percent of total tax revenue, compared with 27 percent for all other OECD countries combined.

We rely very heavily on income taxes from wages. But couldn’t the very rich pay a lot more?

Social Security Contributions: The United States collected less revenue from retirement, disability, and other social security programs—24 percent of total tax revenue—than the 29 percent average across the 37 other OECD countries. Some countries were well above that average: the Czech Republic, Japan, Slovak Republic, and Slovenia each collected over 40 percent of their revenue from Social Security contributions.

Compared to others, the U.S. invests much less in the “security” of their seniors. Much less for the disabled. This is an issue of human values – morality. If you think you won’t ever get old, or never have a car accident…then you might like this embarrassing statistic.

Property Taxes: Taxes on property, estates, and gifts provided 11 percent of US tax revenue, compared with 7 percent for all other OECD countries. Almost all revenue from taxes on property in the US is collected by state and local governments.

And the bulk of those property taxes are for education. I call it zip code funding. Those with fancy homes give their kids a fancy education. Which, of course, perpetuates a class society. A legacy educational system – excluding the poor from equal opportunity.

Goods and Services Taxes: The United States relies less on taxes on goods and services (including both general consumption taxes and selective sales taxes on specific goods and services) than any other OECD country, collecting 17 percent of tax revenue this way compared with 28 percent for the rest of the OECD. Chile collected the highest share of its total tax revenue from taxes on goods and services (53 percent).

The U.S. compares favorably if you agree that taxes on goods and services are regressive – unfairly and disproportionately taxing the poor and middle class. Of course, we could take a more “progressive approach” to this by levying even higher tax rates on super luxury items like jewelry, “art”, yachts, private planes and other high end toys. How about no taxes on essentials priced for the poor and a 50% tax on designer dresses?

The value-added tax (VAT)—a type of general consumption tax collected in stages—is the main source of consumption tax revenue within the OECD. The VAT is employed worldwide in 160 countries, including in all 37 OECD member countries except the United States. Most consumption tax revenue in the United States is collected by state and local governments.

I am not a fan of “VAT” taxes. Because they are sneaky. Effective but hidden. A product could be taxed at several levels – starting with the raw materials, then the means of distribution, then the more fully assembled part, then the distribution of the larger part, and then the final assembled product. The government is getting its “taste” multiple times, effectively raising the price for everyone.

Truly REGRESSIVE. Punishing most of us – especially the poorest of us.

Part 2 – The Con

The “Big Beautiful Bill” has passed. It is a travesty unless you are very rich.

My ultimate takeaway is that the “con” is in the complexity. Almost no voters or taxpayers can understand even a small fraction of this bill and our outrageously complex tax code. That is by design. And the design is to provide the rich with as many loopholes as possible to avoid paying a fair share. The rest of us carry the burden. And the pain of the debt.

From the Tax Foundation:

”The bill further complicates the tax code in several ways, sending taxpayers through a maze of new rules and compliance costs that in many cases probably outweigh any potential tax benefits.”

”The tax and spending provisions would increase the budget deficit by $1.7 trillion from 2025 through 2034 on a dynamic basis, and that higher budget deficit would require the US government to borrow more. As interest payments on the debt made to foreigners increase, American incomes decrease.”

And the burden isn’t just in our taxes. It’s in the diabolical scheme to create MORE government debt. It is deliberate. The MAGA “conservatives” use that debt as a bludgeon to claim that the poor are bankrupting the country. Pure bullshit. It is the rich (the entitled few) who are bankrupting the U.S. by hoarding their wealth. And why? Is life really better and more satisfying if somebody has $100 billion rather than $1 billion? What is enough? How many homes, boats and jewelry or art can someone need?

Of course, what those extra $billions do get is the ability to buy elections, legislation and judges. Thank you Supreme Court and “Citizens United”.

This “beautiful” bill adds trillions to the national debt and cuts $100s of billions for social services to those who need it most. Medicaid, Medicare. Hospitals, doctors, nursing homes, food assistance. Cruelty on steroids.

And the affluent can cut their taxes even more by buying more homes, boats and expensive cars They BORROW – deducting the interest costs. They don’t just purchase with their cash. They use their money get more money and pay less taxes in the process!

This is oligarchy. This is an economic con for the ages.

Part 3 – A solution

What follows is a newsletter from the “Patriotic Millionaires” – a group who is seeking Economic Justice.

Hi Friends of the Patriotic Millionaires,

Yesterday, we teased that we would be sharing a forthcoming solution to the way our tax code unfairly pits our money against your sweat. Today, we’re happy to share what we’ve been working on to reach this very important moment.

Earlier today, a number of our members joined Congresswoman Delia C. Ramirez (IL-03) on Capitol Hill to introduce the Equal Tax Act. This landmark piece of legislation makes the tax code more equitable by taxing investment income at the same rate as ordinary labor income and by closing the stepped-up basis and other common loopholes used by the wealthy to avoid paying their fair share. It’s the first of four pieces of legislation that make up our legislative platform, The MONEY Agenda: America 250, that puts working people at the center of economic policy.

Here we are with Congresswoman Ramirez at our press conference to announce the introduction of the Equal Tax Act.

You can watch a full recording of the press conference here. (Remarks begin at the 9:35 mark.) Also be sure to check out our posts on X, Bluesky, Threads, Facebook, Instagram, and LinkedIn.

The Equal Tax Act would ensure that millionaires and billionaires, who earn most of their money passively through investments, pay the same tax rates as newspaper reporters, dental hygienists, and auto mechanics. Remember what we said yesterday: every dollar that we make through our investments is worth more than every dollar most Americans make at their jobs because, as it’s currently written, the federal tax code taxes ordinary labor income at a higher rate than capital income.

The legislation would also close a number of loopholes that allow the wealthy to avoid paying what they owe the country in taxes. This includes the stepped-up basis, which, if you remember, gives wealthy inheritor families the opportunity to avoid tax completely on capital income.

In full, the Equal Tax Act does the following:

Limits the lower preferential tax rate for long-term capital gains and dividends to incomes under $1 million. The bill maintains the preferred rate for working people who may have money in a 401(k) or the like. The higher tax will only apply to the first dollar over $1 million.

Ends the stepped-up basis loophole and disrupts the “buy, borrow, die” strategy used by the wealthy to avoid taxation by treating capital gains as realized at the time of gift or death, with exclusion allowances of up to $1 million in gains.

Enacts a lifetime limit of $1 million on the use of like-kind exchanges on real estate gains.

Limits the pass-through deduction to incomes under $1 million.

Offers very generous protections for family farms and small businesses.

The preferential treatment of capital income over labor income is both intellectually indefensible and grossly unfair. Money is money is money is money—or at least it should be—regardless of how you make it. That’s why the Equal Tax Act is so important.

Here’s another reason why. Inequality in America has reached historic, democracy-destabilizing heights. And when one kind of money is taxed less than another, growing inequality is baked into our society by the math. That’s a recipe for disaster, because inequality—when it reaches a certain level—leads by definition to authoritarianism. And if the events of the last few days and weeks have told us anything, we are already there in America.

To beat back the oligarchical coup that’s currently threatening everything we hold dear in America, we must advance a new vision for the economy. We must structure the economy so that it naturally delivers more stable, more equal outcomes. That starts by treating income the same regardless of how you make it. We’re glad to have done our part by working with Congresswoman Ramirez to introduce the Equal Tax Act today to make it happen.

Warmly,

The Patriotic Millionaires

That was a lot to digest. Here’s simple summary:

Our tax code is designed to make ultra wealthy people wealthier.

The tax systems of many other “happier” nations support the well being of the whole population – not just the few.

The Patriotic Millionaires have a fiscally responsible way to improve the lives of hundreds of millions of Americans without causing the rich any harm or raising the national debt. Read it here: The Money Agenda – America 250

Article source:

https://taxpolicycenter.org/briefing-book/how-do-us-taxes-compare-internationally

Economic Nerd Opportunity:

https://tradingeconomics.com/stream

Corporate Tax rates worldwide (very nerdy):

https://taxfoundation.org/data/all/global/corporate-tax-rates-by-country-2024/

Assessment of the “Big Beautiful Bill” (as passed by the U.S. House of Representatives):

https://taxfoundation.org/blog/one-big-beautiful-bill-pros-cons/

Eight Men own half the wealth on the Planet

https://thewire.in/world/half-of-worlds-wealth-in-the-pockets-of-just-eight-men

A recipe for Economic Justice

https://patrioticmillionaires.org/wp-content/uploads/2025/03/America-250_-The-Money-Agenda-Exec-Summary.pdf

Rich people fighting for all of us

https://patrioticmillionaires.org/

”Tax the Rich, Pay the People, Spread the Power”

Leave a comment