Everything is YOUR fault

Mr. President. We have a problem.

I Googled “latest measures of food inflation”. The first result to appear is an “AI Overview”.

”AI Overview

As of August 2025, U.S. food inflation was 3.2% over the past year, a faster rate than overall inflation. For August 2025, food-at-home (grocery) prices increased 2.7% year-over-year, while food-away-from-home (restaurant) prices rose 3.9%. The Food and Agriculture Organization (FAO) Food Price Index was 3.4% higher year-over-year in September 2025.

U.S. inflation (August 2025)

Overall food inflation: 3.2%

Food at home (groceries): 2.7%

Food away from home (restaurants): 3.9%”

The next Google result that appears is a statement for September 25 from the Economic Research Service of the FDA. If you have the time and bandwidth to scroll through it, you may get the same impression I did. It seems to “normalize” and downplay the real life costs of eating in America. It rationalizes the stats by suggesting that inflation has been worse. This is true. But does that alleviate the painful current problem?

One would hope to see the newest data in a few days. But. There is a banner at the top of the website – OUR GOVERNMENT’s website that should send shivers down your spine:

”Due to the Radical Left Democrat shutdown, this government website will not be updated during the funding lapse.

President Trump has made it clear he wants to keep the government open and support those who feed, fuel, and clothe the American people.”

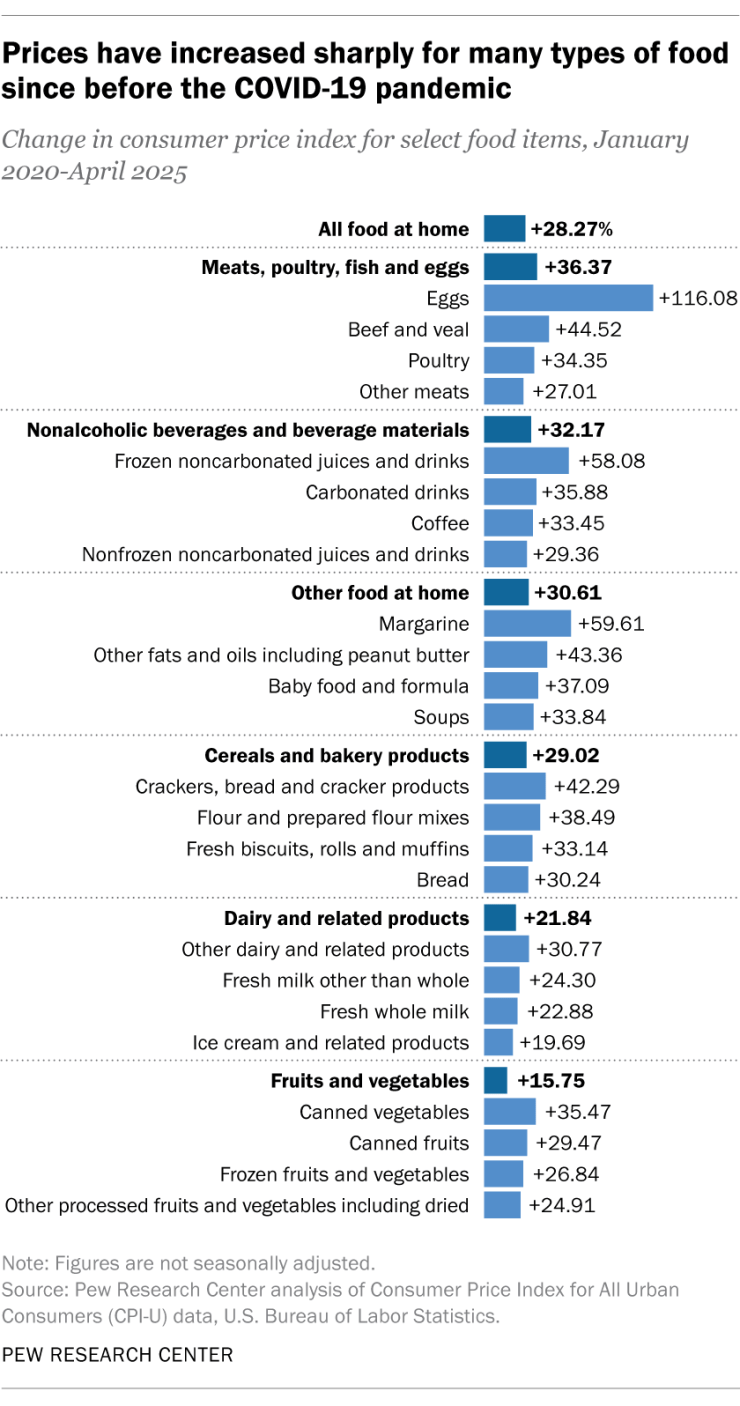

I tried another search. “root causes of food inflation”. I looked for a source that is factual and truly independent of political influence. The PEW Research Center is one I trust. So here is a more revealing way to look at food prices. From the point of view of the consumer.

The following is not the fault of any president. Donald Trump didn’t create the pandemic and Joe Biden inherited the fallout. But what matters now? There is an extreme crisis in food prices for the Americans that are not experiencing the “new prosperity”.

Past politicians have used the phrase “There are two Americas”. That has always been the case. But intelligent, 21st Century leaders could have improved on that. We are, after all, a really VERY rich nation. As a whole. But right now, sharing is not trending.

So here we are Mr. President. As Harry Truman said “The buck stops here.” You may not be clear on this. But here is the harsh, unadulterated, forever the case, truth:

EVERYTHING that happens from here on in – is on YOU. The president. EVERYTHING.

But wait, wait, sir…you say you have a solution! Import more beef to increase supply and lower prices. Brilliant! Does that mean you are going to dispose of those silly price hiking tariffs – like the 50% on a major beef exporter like Brazil? I am having a bit of a math problem here. But I am sure you can bullshit your way through this issue.

Or you can just blow up another boat of unknown people to distract us. As modern TV has taught us, murder is always an attention getter. And apparently, your dumping shit on your fellow Americans is your answer to the question: “How do we survive when prices keep going up?”

However, it ain’t gonna work for long. Because we all need to shop soon…

For a broader view of how American prosperity is currently “shared”, please watch this segment of the PBS NewsHour. The video is set for Paul Solman’s explanation.

If you are comfortably in that top 10% of Americans that is driving 50% of current consumption, enjoy. But when the rest of us can’t consume what we could in the past, something happens. Consumer spending represents about 2/3 of the American economy (GDP). When half of us must reduce that spending – no choice, everything is too expensive – corporate earnings are impacted.

The standard measure of stock market “health” and trends is the price to earnings ratio. The markets are now at a historically high P/E ratio. Rising significantly each week. Stock markets are very driven by emotion and the psychology of the day. “Looks like the Fed will drop interest rates! Buy!”

But sooner or later, companies have to show a level of profits that are sustainable and justify their stock prices.

Simply put, consumers in pain will slow down their spending, profits will drop, and stock markets will head south. The big market collapses of 2000 and 2008 were preceded by very high unsustainable P/E ratios.

But I am no stock market guru. Let’s ask Google AI:

”Yes, the S&P 500 P/E ratio is considered high by historical standards, with current figures like the forward P/E around 23 and a 10-year P/E around 37, both significantly above the long-term average of about 16. This suggests stocks may be overvalued, indicating potentially lower future returns and a higher risk of a market correction. Some analysts argue that a new era of higher valuations might be the norm, driven by factors like strong technology companies, while others believe the high P/E signals a high-risk environment, especially with other economic pressures present.”

“What the S&P 500 P/E ratio indicates

High P/E ratio:

The current P/E ratio is higher than the historical average, which can suggest that the stock market is overvalued.

Forward vs. Trailing:

The forward P/E (based on future earnings) is around 23, while the 10-year P/E is around 37, both significantly above the long-term average P/E of 16.

Historical context:

P/E ratios this high have only been seen during periods like the late 1990s Dot-com bubble and the lead-up to the 2020 market correction, which were followed by significant market downturns.”

When will that inflection point be hit? What event will be the trigger? What will cause a loss of confidence and a significant correction? And what will cause even the top 10 or 20% to reduce spending? Further propelling the the spiral dive? This amateur predicts this:

There will be an earnings season where corporate profits show significant weakness – companies won’t meet (or exceed – that’s the normal expectation) the consensus earning estimates and forecasts. Basically, not delivering as promised.

And fueling the panic will be the realization that AI is not going to provide the outsized profits promised and heavily invested in. Again, ironically, a Google AI answer:

”While there is no universally agreed-upon “AI stock” category, JPMorgan reported in October 2025 that a basket of 30 names linked to artificial intelligence made up about 44% of the S&P 500’s total market value.”

If AI doesn’t start to deliver on its “profits promises” and consumers simultaneously reduce spending, we will have reached the edge of a cliff.

And Mr. President, it will ALL BE YOUR FAULT. Why? Because that’s just how it works, sir. Anything goes wrong, it’s on you. Ask Joe. Ask Barack, Ask Bill.

Jesse says it quite well. Guess we all need to “work harder” – ‘cause we’ve just been much too lazy…right?

https://www.ers.usda.gov/data-products/food-price-outlook/summary-findings

Leave a comment